Dealing with roof damage can be daunting, but taking it step-by-step makes it manageable. Start by thoroughly assessing and documenting the damage with clear photos and videos. Then, review your insurance policy to understand your coverage. Contact your insurer promptly with a detailed description and evidence of the damage. Protect your home with temporary repairs and keep receipts for any expenses. When meeting the adjuster, provide all documented proof. Obtain multiple repair estimates to ensure you get fair pricing and quality service. Following up regularly keeps the process smooth. To truly master the next steps and ensure success, continue below.

Navigating Roof Damage Claims

- Thoroughly assess and document all roof damage with clear, time-stamped photos and detailed notes.

- Review and understand your insurance policy, including coverage details, exclusions, and deductibles.

- Contact your insurance provider promptly with your policy details and a factual description of the damage.

- Make temporary repairs to prevent further damage and keep receipts for reimbursement.

- Regularly follow up with your insurance adjuster to ensure a smooth and timely claims process.

Assess the Damage

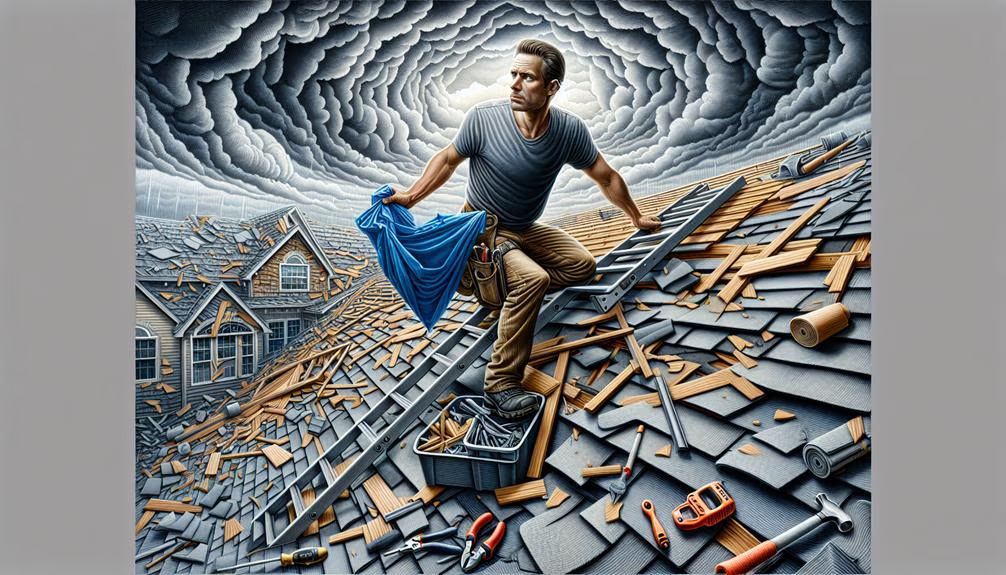

Often, the first step in filing an insurance claim for roof damage involves a thorough and meticulous assessment of the extent of the damage. I remember the time when a fierce storm ravaged my neighborhood, leaving my roof in shambles. The feeling of helplessness was overwhelming, but I knew I had to act swiftly. Getting up on that ladder, I surveyed every shingle, every tile, and every nook and cranny, noting the cracks, missing pieces, and any water damage.

This initial inspection is not just about spotting the obvious; it's about understanding the full scope of the damage. Personal experience has taught me that sometimes the most insidious issues are hidden, like the slow seeping of water that can rot the wooden understructure. It's crucial to document everything meticulously—take clear, detailed photographs and jot down notes. This not only aids in painting an accurate picture for your insurance company but also helps calm your mind amidst the chaos.

The emotional weight of seeing your home damaged can be heavy, but this step is empowering. It transforms a situation of despair into one of proactive control, setting the stage for a successful claim.

Review Your Policy

After meticulously documenting the damage, the next imperative step is to review your insurance policy to understand the coverage and limitations. This stage can feel overwhelming, but it's crucial to know exactly what your policy entails to avoid any unpleasant surprises. I remember poring over the fine print of my own policy, feeling a mix of anxiety and hope, hoping that my coverage was sufficient to address the damage.

When reviewing your policy, pay close attention to the following areas:

- Coverage Details: Identify what types of roof damage are covered, whether it includes issues caused by natural disasters like storms or only certain conditions.

- Exclusions: Be aware of what is not covered. Some policies may exclude damages due to wear and tear or lack of maintenance, which can be a painful realization.

- Deductibles and Limits: Understand the deductible amount you're responsible for and any coverage limits that might cap the amount you can claim.

Reviewing your policy can be an emotional rollercoaster, filled with highs of relief and lows of dismay. But this critical step ensures you are well-prepared and knowledgeable about your rights and obligations, setting a solid foundation for the claim process ahead.

Document the Damage

Standing on my porch, heart pounding, I knew that documenting the roof damage with meticulous detail was the next crucial step in this daunting process. The sight of the shattered shingles and warped wood filled me with a sense of urgency and responsibility. With my smartphone in hand, I began capturing photos from every conceivable angle, ensuring that no detail was left unnoticed. Each click of the camera felt like a small victory, a step closer to restoring normalcy.

I zoomed in on specific areas where the damage was most severe, highlighting the cracks and missing tiles. It was important to include time-stamped images as proof of when the damage occurred. My next move was to make a video walkthrough, narrating the extent of the destruction while capturing a comprehensive visual record.

I then took notes, jotting down observations on a notepad—details like the date of the storm and the immediate aftermath. This written account would serve as a supplementary document to strengthen my claim. The process, though emotionally draining, gave me a sense of control and preparedness, reassuring me that I was doing everything possible to secure the necessary repairs.

Contact Your Insurance

Reaching out to your insurance company can feel daunting, but it's a crucial step. Have your policy details at your fingertips to ease the process. When you initiate your claim, clear communication will help ensure a smoother experience.

Gather Policy Information

Understanding your insurance policy details is crucial as it lays the foundation for a successful roof damage claim. Reflecting on my own experience, I remember the overwhelming sense of urgency and confusion when my roof was damaged by a severe storm. At that moment, having a clear understanding of my insurance policy was a beacon of hope. I cannot stress enough the importance of gathering your policy information meticulously.

When contacting your insurance company, ensure you have the following details at hand:

- Policy Number: This is your unique identifier and is essential for any communication with your insurer.

- Coverage Details: Familiarize yourself with what your policy covers, including exclusions and limitations.

- Deductible Amount: Knowing your deductible helps you understand your financial responsibility before the insurance kicks in.

This step can feel daunting, but it's your first move towards regaining control after the distress of roof damage. Personally, I found that having these details ready not only expedited the process but also provided a sense of relief. Remember, your insurer is there to assist, but clear communication starts with you knowing your policy inside out. Armed with this information, you are better prepared to navigate the subsequent steps with confidence.

Initiate Claim Process

Embarking on the claim process can feel like navigating through a storm, but prompt and precise action ensures you are on the path to recovery. My heart raced when I first contacted my insurance company, but I quickly realized that clear communication made all the difference.

First, reach out to your insurer as soon as you notice the damage. Time is of the essence; delays can complicate the claim. When I picked up the phone, the customer service representative guided me through the initial steps, which eased my anxiety. Have your policy number and details readily available, as this information is vital for a smooth conversation.

Describe the damage thoroughly, but remain factual. I found it helpful to take notes during the call, ensuring I captured every detail and instruction. The representative will likely schedule an adjuster's visit to inspect the damage—this is your opportunity to provide any photos or documents you've gathered.

Temporary Repairs

Securing your home with temporary repairs is crucial to prevent further damage while waiting for the insurance claim process to unfold. As someone who has navigated the turbulent waters of dealing with roof damage, I understand the emotional and physical strain it can impose on a household. The last thing you need is more damage compounding the initial problem. Temporary repairs can be a lifeline, a way to protect your sanctuary until permanent solutions are in place.

From my personal experience, the following steps can make a world of difference in safeguarding your home:

- Cover exposed areas: Use tarps or heavy-duty plastic sheets to cover any exposed sections. This acts as a barrier against rain and debris.

- Clear debris: Remove any fallen branches, leaves, or other debris from the roof to prevent further damage and to make the area safer for temporary repairs.

- Secure loose shingles: If you can safely access your roof, securing loose shingles can prevent them from blowing off and causing more issues.

These temporary measures not only protect your home but also provide peace of mind during an already stressful time. Taking prompt action can make the insurance claim process smoother and more effective.

File the Claim

Often, the moment you realize it's time to file an insurance claim for roof damage, a wave of anxiety and uncertainty can wash over you. The process may seem daunting, but taking it step-by-step can ease your concerns. Start by contacting your insurance company promptly. Having gone through this myself, I can attest that the sooner you notify them, the better. Trust me, this initial call is crucial to setting the wheels in motion.

Gather all necessary documentation before making the call. This includes photographs of the damage, receipts for any temporary repairs, and your insurance policy details. By being organized, you demonstrate your diligence and make the process smoother for both parties. I remember feeling a sense of relief once I had everything in one place; it felt like reclaiming some control in a stressful situation.

Be prepared to answer detailed questions about the damage, including when and how it occurred. This detailed account helps your insurer to assess the situation accurately. Your emotional connection to your home can make this challenging, but staying calm and factual is key. The clarity you provide here can significantly impact the efficiency and outcome of your claim.

Meet the Adjuster

Meeting the adjuster was an eye-opening experience that highlighted the importance of being fully prepared. Scheduling the appointment felt like a crucial step towards resolving the damage, and I knew having all necessary documents ready would make a significant difference. As the day approached, I gathered every piece of evidence and documentation to ensure a smooth and efficient evaluation process.

Scheduling the Appointment

Scheduling the appointment with the insurance adjuster can feel like a pivotal step in the process of filing a roof damage claim. This phase is often laden with emotions, ranging from anxiety to hope, as it marks the moment when your claim begins to transform into tangible action. The adjuster's visit is your opportunity to showcase the extent of the damage and ensure your roof gets the necessary attention and repairs.

Here are some critical aspects to consider when setting up this appointment:

- Flexibility: Be prepared to accommodate the adjuster's schedule as much as possible. Their availability can sometimes be limited, and flexibility can expedite the process.

- Preparation: Mentally prepare yourself to discuss the damage in detail. Reflect on the storm or incident that caused the damage, and be ready to narrate it.

- Documentation: Gather all preliminary photos and evidence you have of the damage. This will aid the adjuster in assessing the situation accurately.

Personally, I remember feeling a mix of relief and apprehension when setting up my appointment. Knowing the adjuster was coming meant progress, yet it also felt like a significant, daunting step. Being prepared and understanding the importance of this meeting can help alleviate some of that anxiety.

Preparing Necessary Documents

As the day of the adjuster's visit approaches, gathering all necessary documents becomes a critical task to ensure a smooth and thorough assessment of your roof damage. The night before, you might find yourself rifling through drawers, feeling the weight of anxiety and anticipation. It's essential to have every piece of paper ready to present to the adjuster. When I went through this, I felt an overwhelming sense of relief when I saw the adjuster nodding in approval of my organized documents.

Here is a handy checklist for ensuring you have everything you need:

| Document Type | Description |

|---|---|

| Insurance Policy | A copy of your insurance policy detailing coverage. |

| Damage Photos | Clear, dated photos of the roof damage. |

| Repair Estimates | Written estimates from contractors on repair costs. |

| Receipts and Invoices | Receipts for any temporary repairs or related expenses. |

| Correspondence Records | Emails, letters, and notes from conversations with insurers. |

This table encapsulates the essentials. Each document tells a part of your story, illustrating the impact the damage has had on your life. By being meticulously prepared, you're not just showing the adjuster the damage but also demonstrating your commitment to resolving the issue efficiently.

Get Repair Estimates

Obtaining accurate repair estimates is crucial for ensuring that your roof damage claim is processed smoothly and fairly. I remember the anxiety I felt when my roof suffered storm damage; the uncertainty of costs was overwhelming. But getting those estimates helped ground me, providing clarity and a roadmap for the next steps.

- Comprehensive Assessment: Ensure that the contractor evaluates every aspect of the damage. Overlooking minor issues can lead to significant problems down the line.

- Itemized Estimates: An itemized breakdown of costs helps in understanding what each repair entails. It also ensures transparency, making it easier for the insurance adjuster to process your claim.

- Multiple Quotes: Obtaining estimates from at least three different contractors gives a broader perspective on fair pricing and the scope of work required. This can prevent under- or overestimation of repair costs.

These steps, though seemingly minor, can make a huge difference in the insurance claim process. Clear, accurate estimates act as a solid foundation, not only for your claim but also for your peace of mind. When I received my estimates, it felt like a weight lifted off my shoulders, knowing I had a clearer path forward.

Choose a Contractor

Selecting the right contractor is a critical step in restoring your roof after damage. It's essential to verify their credentials to ensure they are reputable and qualified. Additionally, obtaining multiple bids can provide you with a clearer picture of the scope and cost of the work needed, safeguarding your investment.

Verify Contractor Credentials

Ensuring that your chosen contractor has the proper credentials is crucial for the successful repair of your roof. It's not just about finding someone who can do the job; it's about finding someone you can trust with your home. When my roof was damaged, I learned the hard way how vital it is to verify a contractor's credentials. This step can save you from future headaches and financial losses.

To ensure you're making the right choice, consider the following:

- Licensing and Insurance: Verify that the contractor holds the necessary state licenses and insurance policies. This protects you from liability in case of accidents or further damage.

- References and Reviews: Ask for references and read online reviews. Personal experiences from previous clients can give you valuable insights into the contractor's reliability and quality of work.

- Certifications: Look for certifications from roofing manufacturers or industry associations. These often indicate a higher level of expertise and professionalism.

These measures may seem like extra steps, but they are essential for peace of mind. The right contractor will not only restore your roof but also your sense of security in your home.

Obtain Multiple Bids

One of the most valuable lessons I learned during my roof repair journey was the importance of gathering multiple bids to make an informed decision. This process felt overwhelming at first, but I soon realized how crucial it was for safeguarding my investment and ensuring the quality of the work. Each contractor had their own approach, pricing, and timeframes, which gave me a comprehensive understanding of what my options were.

The emotional rollercoaster began with the first bid. I felt a mix of relief and apprehension—relief that professionals were ready to help, but apprehension about choosing the right one. As I gathered more bids, my confidence grew. I started noticing discrepancies in pricing and services that I would have missed had I only consulted one contractor.

Ultimately, obtaining multiple bids empowered me to negotiate better terms and select a contractor who not only fit my budget but also met my standards for quality and reliability. It was comforting to know that I wasn't making this significant decision in the dark. This step, though time-consuming, was incredibly worthwhile and left me feeling assured that I had made the best possible choice for my home and peace of mind.

Follow Up

Frequently, the most crucial step in ensuring a smooth claims process is diligently following up with both your insurance provider and contractor. It can feel overwhelming, but your persistence will pay off. After filing the claim, it's essential to keep the lines of communication open and ensure that your case is progressing as it should. Here are some key actions to take:

- Regular Updates: Contact your insurance adjuster regularly for updates on the status of your claim. This not only keeps you informed but also shows that you are proactive and committed.

- Document Everything: Keep a detailed record of all interactions, including dates, names, and the nature of the conversations. This can be invaluable if discrepancies arise.

- Stay Organized: Use a dedicated folder or digital tool to organize all documents, bids, and correspondence. This can help you quickly provide any information requested by the insurance company or contractor.

I remember feeling lost when a storm damaged my roof. The process was daunting, but following up consistently made a significant difference. By staying engaged and organized, you ensure that your claim doesn't fall through the cracks, leading to a faster and more favorable resolution.

Frequently Asked Questions

How Long Does It Take to Process a Roof Damage Insurance Claim?

The duration for processing a roof damage insurance claim can vary significantly. From my personal experience, it often takes between a few weeks to a couple of months. It's a waiting game, filled with anticipation and, at times, frustration. The process involves inspections, paperwork, and approvals, which can feel never-ending. The key is patience and prompt communication with your insurance company to help move things along smoothly.

What Should I Do if My Claim Is Denied?

If your claim is denied, it can be incredibly frustrating and disheartening. First, carefully review the denial letter to understand the specific reasons. Then, gather any additional evidence or documentation that might support your case. Don't hesitate to contact your insurance company for clarification or to discuss the possibility of an appeal. Sometimes, hiring a public adjuster or seeking legal advice can make all the difference.

Can I Negotiate the Settlement Amount With My Insurance Company?

By a stroke of luck, I once found myself negotiating a settlement amount with my insurance company. Yes, you can indeed negotiate the settlement amount. Start by reviewing the adjuster's report, gathering additional repair estimates, and presenting compelling evidence of the roof damage. Persistence pays off, so don't hesitate to push for a fair settlement. Remember, it's your right to advocate for yourself and ensure you're adequately compensated.

Are There Any Roof Damage Scenarios Not Covered by Insurance?

From my own experience, I learned that not all roof damage scenarios are covered by insurance. For instance, damage due to neglect or lack of maintenance often isn't covered. My insurer also didn't cover damage caused by wear and tear or certain natural disasters like earthquakes. It was an eye-opener, emphasizing the importance of understanding policy exclusions and ensuring regular maintenance to avoid unexpected financial burdens.

How Can I Prevent Future Roof Damage to Avoid Future Claims?

To prevent future roof damage, I highly recommend regular maintenance and inspections. Clean gutters to avoid water buildup, trim overhanging branches to prevent physical damage, and ensure proper attic ventilation to avoid moisture accumulation. Investing in high-quality roofing materials and professional installation can also make a significant difference. Personally, these proactive steps have saved me from numerous headaches and costly repairs, giving me peace of mind during stormy seasons.

Conclusion

In conclusion, navigating the labyrinthine process of filing an insurance claim for roof damage necessitates thoroughness and precision at each step. From assessing and documenting the damage to liaising with insurance adjusters and choosing a reputable contractor, every action taken ensures a smoother path to recovery. Ultimately, the diligence in following these steps can render the daunting task of roof repair more manageable, safeguarding one's abode for future generations. Thus, in the grand scheme, patience and attention to detail are paramount.